Will somebody tell me why major news media outlets are hosting ‘experts’ to continuously debate the “rights” of Duck Dynasty patriarch Phil Robertson??

Will somebody tell me why major news media outlets are hosting ‘experts’ to continuously debate the “rights” of Duck Dynasty patriarch Phil Robertson??

I’ll tell you why-or rather, if only because nobody at CNBC knew how to put the issue into real perspective: its because Duck Dynasty has in just one year, become a $400 million annual revenue business. That’s right, the real story, not the reality TV version, is that the brouhaha that has since taken over any remaining intellect on the part of CNN’s programming team, is about money. Do-Re-Me. $400 million a year’s worth.

It is not about any so-called debate as to whether Phil Robertson’s constitutional rights have been violated; A&E, the network that airs this modern version of Beverly Hills Hillbillies, is a corporation whose business is business. Like any other entertainment company, they pay for content that entertains, but they reserve the right to cancel those payment agreements if they, in their sole determination, determine it is not in their best business interest to continue to broadcast said content. This happens when too many members of the audience voice their displeasure and protest, and in turn, causes sponsors/advertisers to cancel their agreements in conformance with standard clauses.

Let’s put this into perspective. The Ducksters attract the world’s biggest retailer’s audience. We’re talking about Walmart. Walmart is the store du jour every day of the week for a vast majority of our country’s underemployed, “economically-disenfranchised” and financially-challenged. This includes a vast population of rednecks such as the personas the Robertson family works hard at emulating. Along the way, their raking in $400 million a year (or at least their ‘brand’ is courtesy of multiple licensing, advertising and sponsorship deals on top of merchandising deals).

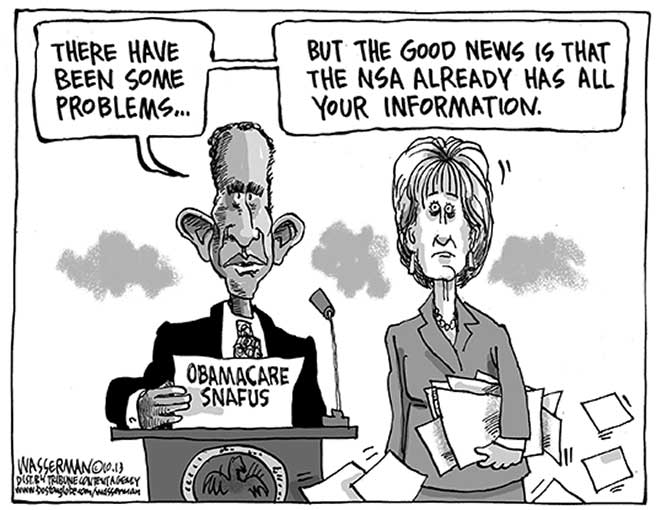

Which brings me back to the opening rhetorical: why are seemingly intelligent news organizations dedicating so much air time to this issue, and more important, why are they framing it as if A&E’s corporate decision should be misconstrued for being anything more than a corporate decision?

Is it because programming execs are focused on maintaining the highest standards of journalism, and reporting stories that have a meaningful impact on society? Do these media czars really and truly believe that this issue even deserves consideration for being a ‘constitutional rights’ debate? Help me by emailing me and telling me this can’t be true.

Or, have the lunatics taken over the asylum and we can attribute this latest insert into the news cycle for the latest rendition of an industry that is merely focused on serving up crap that advertisers are happy to underwrite, simply because the diners are zombies who happen to like eating crap and the other low-priced items those advertisers happen to sell?

By the way, the Ducksters and the folks at A&E are salivating because this ‘incident’ has just added a 2x factor to the value of the Duck Dynasty franchise. The major news networks will simply be remembered for their irresponsibility for profiling this most current example of human stupidity, while the Ducksters laugh all the way to the bank.

News Media Lays Egg With Duck Dynasty Coverage; Social Media Steps to New Lows